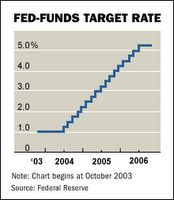

Here is the Press Release from the Federal Reserve Open Market Committee (FOMC). No surprises here for faithful readers of this blog. The bottom line: the FOMC is on pause when it comes to interest rates. We’ll get to look at the third quarter GDP report on Friday. The Fed is predicting a slowdown of growth.

Release Date: October 25, 2006

For immediate release

The Federal Open Market Committee decided today to keep its target for the federal funds rate at 5-1/4 percent.

Economic growth has slowed over the course of the year, partly reflecting a cooling of the housing market. Going forward, the economy seems likely to expand at a moderate pace.

Nonetheless, the Committee judges that some inflation risks remain. The extent and timing of any additional firming that may be needed to address these risks will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Susan S. Bies; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; Sandra Pianalto; William Poole; Kevin M. Warsh; and Janet L. Yellen. Voting against was Jeffrey M. Lacker, who preferred an increase of 25 basis points in the federal funds rate target at this meeting.

Extra Credit: So what is the “federal funds rate”? You can bet you’ll be asked about this on your final exam. If you are the first student to send me an e-mail (kwoodward@saddleback.edu) with the answer, you will be rewarded with two extra credit Discussion Board points. Only two points extra credit per student can be earned in any given week from the blog questions.

No comments:

Post a Comment