There was a plethora of macro data released today. Inflation as measured by the Producer Price Index (PPI) came down in September, thanks to lower oil prices last month. The PPI measures changes in the cost of items purchased by businesses in wholesale markets. The PPI may give an early indication as to where overall inflation is headed. The drop was very sharp in the overall index, though the monthly change in core inflation (inflation excluding food and energy) was higher than many economists had expected. Tomorrow, we’ll get a look at the most closely watched measure of inflation, which is the Consumer Price Index (CPI).

The U.S. Census Bureau estimates that the population of the United States topped 300 million people today. We’ve still got a long way to go until we catch up with China, which is estimated to have about 1 billion and 300 million people.

The U.S. Census Bureau estimates that the population of the United States topped 300 million people today. We’ve still got a long way to go until we catch up with China, which is estimated to have about 1 billion and 300 million people.

In other macro news, the Federal Reserve said industrial production dropped in September by 0.6%, while capacity utilization fell 0.6% to 81.9%. Not so good.

I’m not sure quite what to make of all these numbers. Macrominds are always careful about reading too much into one month’s worth of data. To me the big picture points to a slowing of economic growth.

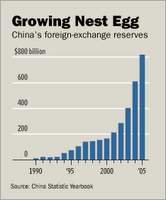

A story (at least in terms of its long run significance) that caught my attention was a report in The Wall Street Journal that China’s foreign exchange reserves had topped one trillion dollars:

"Sometime in the next few days, China's holdings of foreign currencies and securities will top $1 trillion -- a sum greater than the annual economic output of all but nine countries. The rapid growth in these so-called foreign-exchange reserves has made Beijing a colossus in the financial world, cushioned against shocks at home, but potentially able to trigger them abroad.

How China manages its growing pool of wealth has major repercussions for the global economy. … For the U.S., how China deploys its reserves is a question of some consequence. Most of China's currency reserves are invested in U.S.-dollar-denominated debt, such as U.S. Treasurys, which are considered the world's safest investment. That has kept demand for U.S. Treasury notes high -- and interest rates low. A change in that pattern could affect how much Americans pay for mortgage loans and other borrowings.

Some in Washington and in world markets fear that China might one day dump its holdings of dollar-based assets, setting off a tidal wave of sales that might swamp the U.S. economy. Despite such fears, there's no sign that China is making a major move out of dollars and into euros or other foreign currencies, even though Chinese economists have occasionally warned that the weak dollar holds down the value of China's holdings." (“China's Reserves near Milestone, Underscoring Its Financial Clout” by Andrew Browne, The Wall Street Journal, October 17, 2006)

Where did all these dollars in China come from? You might want to check out your clothes closet, toy chest, or consumer electronics.

Extra credit: What do economists mean by “core inflation”? Why is it important? The answer may not be in your text. If you are the first student to send me an e-mail (kwoodward@saddleback.edu) with the answer, you will be rewarded with two extra credit Discussion Board points. Only two points extra credit per student can be earned in any given week from the blog questions.

Extra credit: What do economists mean by “core inflation”? Why is it important? The answer may not be in your text. If you are the first student to send me an e-mail (kwoodward@saddleback.edu) with the answer, you will be rewarded with two extra credit Discussion Board points. Only two points extra credit per student can be earned in any given week from the blog questions.

No comments:

Post a Comment